Our goal is to create and build 185 public benefit companies across 9 areas of impact. Different from traditional accelerators and venture capital firms, we create and participate in the funding of our companies from hypothesis through scale.

Invention Process:

We uniquely operate at the intersection of themes as long term secular drivers of commercial value and areas of impact where we address societal challenges.

Themes

Themes are long term secular key drivers that capture economic, technological, and social changes. Our Themes are anchored in recognizing that we are at the very beginning of an “Emerging Technology” super cycle, a period of unprecedented growth and innovation in artificial intelligence, asset tokenization, blockchain, additive manufacturing, and opportunities at the intersection of hardware, software and data.

This phenomenon is driven by several key factors, including the explosive growth of big data, the increasing power and sophistication of machine learning algorithms, and the rapid adoption of AI-based solutions across a wide range of industries. We deeply consider how emerging technologies can be used for positive social impact.

Since societal problems are non-static, themes provide broad guidance in creating forward looking solutions that provide value to impact customers. We regularly consider events and market activity to determine whether our theses are correct.

Areas of Impact

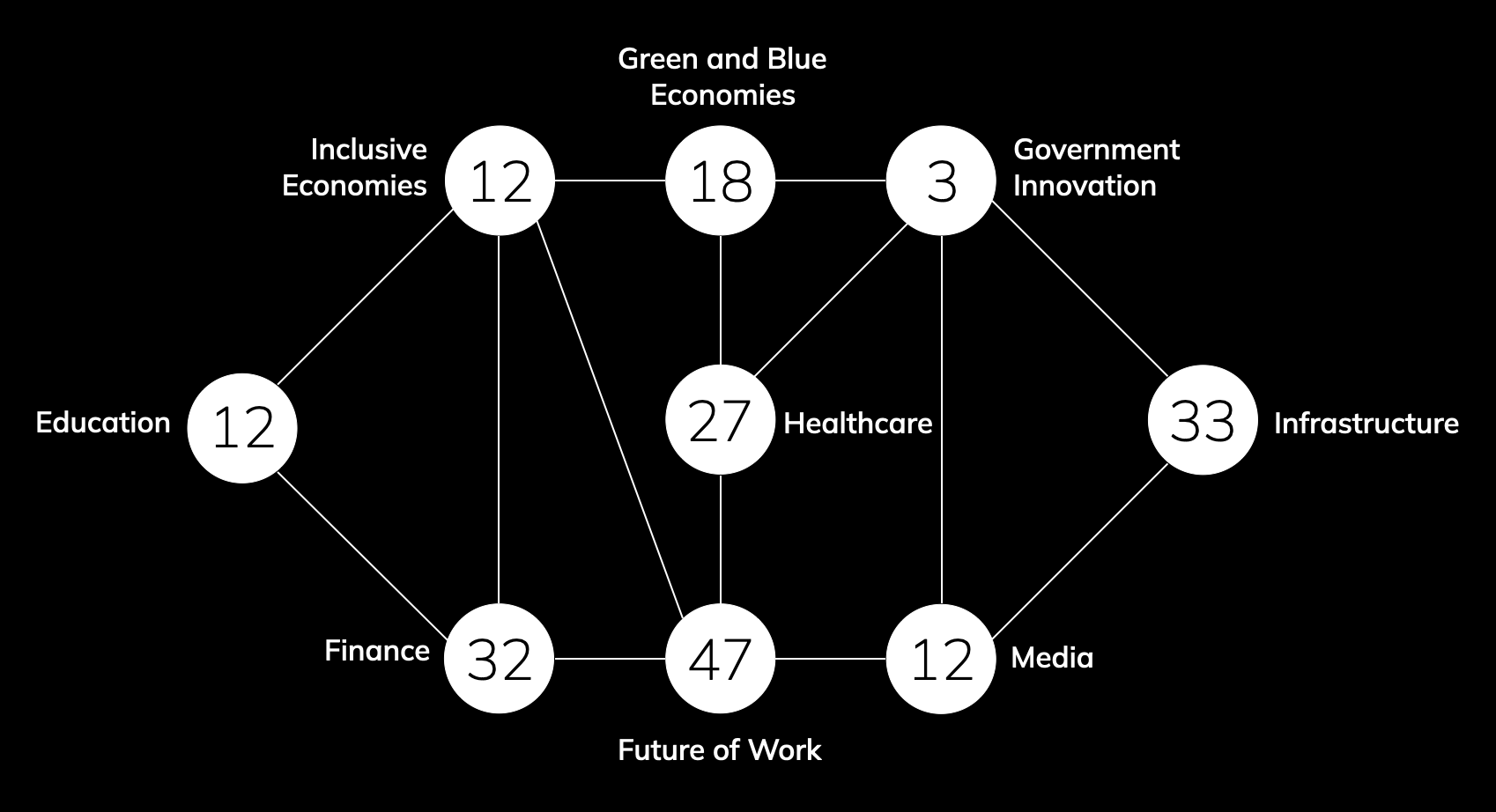

Societal challenges are often deeply intertwined. Accordingly, we create businesses in 9 areas of impact: Education, Finance, Future of Work, Government Innovation, Green and Blue Economy, Healthcare, Inclusive Economies, Infrastructure, and Media.

Systematic Development: Recognizing that most new ventures fail early in their lifetime, we utilize a structured methodology to increase our rate of success.

The process includes a number of internally developed tools: y-Validation, 5 fits, theory of change/risk scorecard. Innovation is core to everything we do. For example, within y-Validation is the notion of COM (Core Obtainable Market), which is more important than the standard market sizing elements of TAM (Total Addressable Market), SAM (Serviceable Addressable Market), and SOM (Serviceable Obtainable Market).

Rather than build idiosyncratic companies, our portfolio companies are built to work together. We combine our Year 1 companies to create our Frameworks as Solutions product, which enables organizations to increase the velocity of value creation.

The frameworks allow corporates, nonprofits, universities city/agencies, to navigate rapid change and unprecedented uncertainty.

Transformation

Accountability structures and change management

Adaptive strategy, responsive implementation, and team acumen

AI Impact on the Organization

Growth acceleration

Integrated Revenue Model: Accelerating Customer Value

People & Equity: Human resources to human capital

Resilience & Sustainability

Transformation through customer success

Transformation through Data and Measurement: Strategy and Operating Models

Higher Education: Aligning student outcomes, institutional strategy, and sustainability

Healthcare System: Aligning patient outcomes, institutional strategy, and sustainability

Operational Improvement and Scalability

Risk

Customer experience and service to customer success transformation

Maximize results per budget envelope

AI Impact on the Organization

Organizational benchmarking and design

Supply chain

Team acumen

Cyber strategy and risk

Finance strategy and risk

Operational risk